Our Fee Structure

We commence the advice process with an ‘Introductory’ meeting, which is a one hour session. At this meeting we ascertain the type of advice you require, based on what you’d like to achieve. This meeting allows us to answer basic general financial questions, which may assist you to outline your strategic direction (but doesn’t include personalised advice). The cost of this meeting is $330 (inc GST), which is then rebated against advice fees if proceeding further.

If we then agree to proceed further, a quote for advice will be given. All quotes are provided in written form, detailing the scope of the advice – i.e. what is and what isn’t covered in the strategy. All advice is provided in writing, in the form of a clearly written Statement of Advice report.

In our experience charging a fee for advice promotes an honest and transparent relationship, in which your needs are the priority. Due to the nature of our work, initial advice is subject to a customised quote rather than a standard fee. This reflects the wide variation in financial circumstances of our clients – in terms of complexity, scope of advice, and portfolio value.

Do You Charge Percentage Based Fees for Advice?

No. We don’t charge percentage based fees (Eg 1% of your portfolio value). For many years we have offered a flat fee approach, based on our hourly rate. Contact us for further details.

Do you need to have a minimum portfolio value to seek advice?

In short, no. However the minimum investment value for our clients is usually $100,000 or above, and most portfolios that we deal with are over $500,000 (this may include super/pension/investment accounts for a couple or family).

Our Service

At JustInvest we realise it takes time to reach your goals and objectives, so we partner with you – not just at the beginning of your journey – but throughout the process, consistently aligning the right planning options with your desired outcomes.

How many successful athletes have reached their full potential without a coach? We believe that with clearly defined goals and ongoing communication, we can make a difference in planning for your future. That way, we can review your progress and celebrate reaching your milestones!

Are you regularly kept up to date with issues affecting your portfolio? JustInvest clients are kept up to date on issues relating to Australian and global markets, investment, super and pension strategies, and legal and regulatory changes.

We recommend that our clients proactively review your portfolio with us once or twice a year. This enables you to keep up to date with information relevant to your portfolio and implement any changes that are required to ensure that your goals and strategies are aligned.

Do you need an accountant, solicitor, general insurance or finance broker? JustInvest’s extensive network of professionals (working independently from us) can assist you in areas we don’t specialise in. Depending on your needs, we can suggest trusted professionals suited to your requirements. Note: we don’t receive remuneration or commissions from referrals to these professionals.

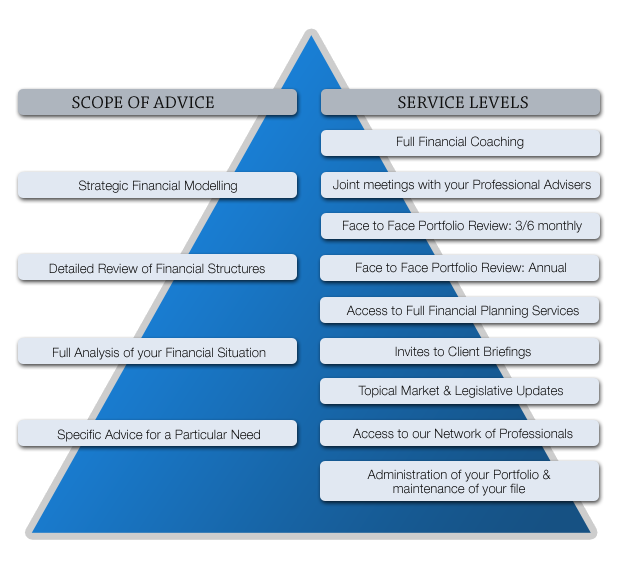

The pyramid below shows that as your scope of advice & level of service increases, so does the value of the outcomes.

Service Levels & Scope of Advice